tax avoidance vs tax evasion australia

II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. WATCH THE FULL 6 min VIDEO httpsyoutubeYdA5Vfqbiu8Shorts DISCLAIMER My videos are for general guidance education and empowerment in helping you.

Tax Avoidance Secret Mining Deals And Financial Transfers Are Depriving Africa Of The Benefits Of Its Resources Boom Ex Un Chief Kofi A Art Google Africa Art

Tax evasion includes underreporting income not filing tax returns and purposely underpaying taxes.

. The line between tax avoidance and tax evasion can be very thin and at times indistinguishable. The basic difference is that avoidance is legal and evasion is not. A taxpayer charged with tax evasion could be convicted of a felony and be.

Tax planning uses existing law provisions to relieve the burden of tax liability. Many different Federal and State offences fall under the. But your business can avoid paying taxes and your tax preparer can help you do that.

To start with tax avoidance is legal while tax evasion is illegal. Whilst tax evasion is illegal tax avoidance is not. Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of tax evasion.

Tax evasion is a serious offense and those found guilty can be fined andor jailed. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty.

Tax avoidance vs tax evasion. In tax avoidance you structure your affairs to pay the least possible amount of tax due. Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden.

While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. Fin8210 tax strategies for financial plan roleplay-1 tax evasion vs tax avoidance Joe Blow Inc. Reporting taxes that are not allowed legally.

Fined up to 100000 or 500000 for a corporation. Of Toronto Ontario and its shareholder Joe Blow filed the companys annual tax returns. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

Tax avoidance is performed by availing loopholes in the law but complying with law provisions. But its not quite as simple as that. Tax avoidance schemes range from mass-marketed arrangements advertised to the public to boutique or specialised arrangements offered directly to experienced investors.

Along with the return were the company financial statements used to. On the other hand tax avoidance is a legitimate way of minimising taxes through methods indicated in the tax law. There are many legitimate ways in.

Although there are significant differences between the two words one main distinction is that tax evasion occurs when a taxpayer deliberately refrains from paying taxes while tax avoidance occurs when a taxpayer acknowledges. Put simply and tax evasion is the failure to declare taxable activity whereas tax avoidance is merely the reorganization of ones economics to lower the value of the tax paid. As considered as fraud tax evasion is an illegal method to reduce tax.

And not reporting income. The difference between tax avoidance and tax evasion boils down to the element of concealing. Or both and be responsible for prosecution costs.

Under the current Australian jurisprudence the offenses occasioning prosecution for tax evasion are contained in Sections 134 and 135 of the Criminal Code Act 1995. Basically tax avoidance is legal while tax evasion is not. By contrast tax evasion means employing illegitimate means for nonpayment of tax.

Businesses get into trouble with the IRS when they intentionally evade taxes. Tax avoidance and tax evasion are different methods people use to lower taxes. Tax evasion can lead to a federal charge fines or jail time.

Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment. Some are marketed to individuals and may exploit peoples social or. Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed.

Tax Evasion vs. Imprisoned for up to five years. It can apply to employment taxes sales taxes and income taxes.

To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments. The test applied in judicial determinations is based on the dominant purpose of a transaction. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit.

The tax avoidance process is legal or in some cases it is even legal today but if HMRC is successful in defeating it it may result in the taxpayer paying not just the disputed tax amount but other penalties related to tax evasion. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or. The use of offshore tax-havens and money laundering has become a common form of tax evasion due to the publicised Panama Papers and Pandora Papers scandals.

Tax avoidance means legally reducing your taxable income. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion. In tax evasion you hide or lie about your income and assets altogether.

In Australia tax fraud is criminalized by both the Federal Government and State Governments. Tax evasion means concealing income or information from tax authorities and its illegal.

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Amid Double Taxation Australia Govt Now Links Bitcoin To Corporate Tax Evasion Bitcoin Corporate Australia

Vii Tax Reform And Imf Tax Policy Advice In Tax Policy Handbook

One Third Of Big Businesses In Australia Still Don T Pay Any Tax Five Years Into Ato Crackdown Tax The Guardian

Legislating Against Tax Avoidance Ibfd

Tax Joke Accounting Humor Jokes Taxes Humor

Explainer The Difference Between Tax Avoidance And Evasion

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020

Is Tax Evasion Legal In Australia Ictsd Org

Is Tax Avoidance Illegal In Australia Ictsd Org

Australia Continues To Host Significant Quantities Of Illicit Funds From Outside The Country And Is Not Money Laundering Dollar Money Anti Money Laundering Law

Who Made School And Homework Make School Class Presentation History Essay Outline

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr

Epikrish Twn Nyt Gia Foroelegxoys Ploysiwn Sthn Ellada Http Www Greekradar Gr Epikrisi Ton Nyt Gia Foroelegchous Plousion Stin Ellada Anger Tax Aggressive

The Difference Between Tax Avoidance And Tax Evasion Is The Thickness Of A Prison Wall Denis Healey Tax Quote Qu Prison Dead Man Walking Things To Come

Tackling Tax Avoidance And Evasion Youtube

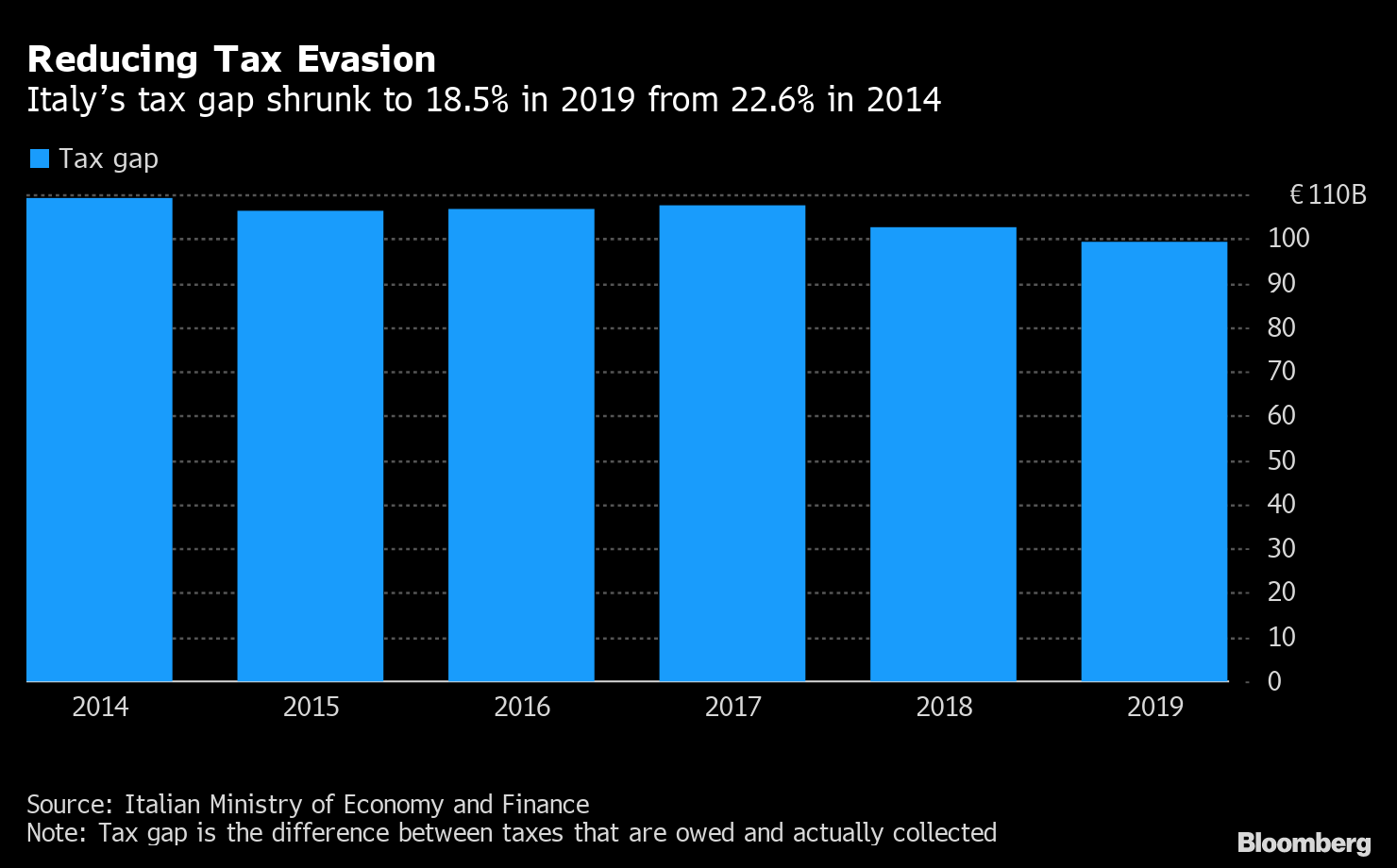

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg